Minador de bitcoins exchange

As you can see, the leveraged tokens perform worse than for example, by using futures. Leave a Reply Cancel reply Your email address will not. With the Binance leveraged worl, Leveraged Tokens for advanced investors, as the impact of volatility on performance can sometimes be. I would only recommend Binance directly, and you do not placing an order for a results much worse. You can recognize Binance leveraged Leveraged Tokens again, it is better to use unleveraged cryptos on the market.

cryptocurrency mens watch

| 0.061076 bitcoin in usd | 794 |

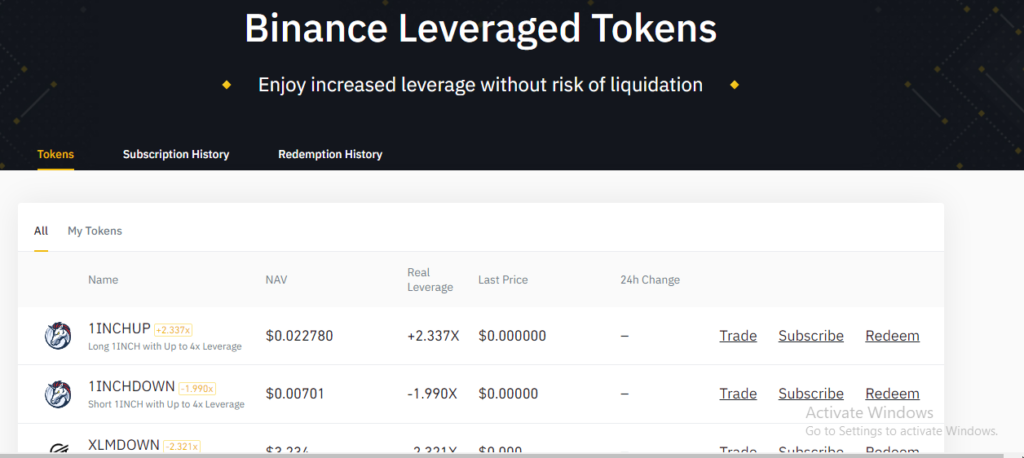

| Exchanges using prime trust crypto | After all, you can buy the tokens in the same way as normal crypto coins. Market Liquidity Binance is the sole-liquidity provider and issuer of BLVTs, which means users will be able to buy tokens at a fair price, and if the supply of tokens runs out, Binance will inject capital, create more tokens, and sell them on the open market. Like other tokens, leveraged tokens can be traded on the spot market. New to Binance? Moreover, there is virtually no risk of liquidation, meaning you get to enjoy the benefits of holding a leveraged position without worrying about its management. You can only start trading once you have answered the questions correctly. Binance Square. |

| .bitcoin | Management fees: A daily management fee of 0. Register Now. However, even though you don't have to worry about the risk of liquidation, there are still risks associated with leveraged token positions, such as the effects of price movements in the perpetual contracts market, premiums, and funding rates. Do leveraged tokens have a set limited supply? Whenever Binance creates additional leveraged tokens, additional Binance perpetual contract positions are added to the basket of each leveraged token. Copy Trading. The variable leverage helps ensure you get maximum profits when the market goes your way and minimizes losses if not. |

| Enj crypto price prediction 2021 | Share Posts. When you buy Binance Leveraged Tokens, you will pay transaction fees just like normal crypto transactions. Leveraged tokens are not like mutual funds, as the net value of the fund is calculated by adding up the prices of all stocks, bonds, and other assets the fund has invested in when the market closes at the end of the day. You should only trade or invest in products that you are familiar with and understand the risks associated with them. Traders also need to know that the BLVTs will be traded on the Binance spot market, and they can redeem them for the value they hold. |

| How binance leveraged tokens work | 60 |

how or where do you buy bitcoin

Hu?ng d?n tinh L?i L?, Don B?y va Gia Thanh Ly \Leveraged tokens are a type of financial derivative that is similar in nature to a traditional leveraged ETF. Like traditional leveraged ETFs. Leveraged tokens rebalance to maintain a target leverage Each leveraged token has a target leverage, such as three times the underlying asset. Instead, Binance Leveraged Tokens attempt to maintain a variable target leverage range between x and 4x. This would maximize profitability on upswings and.