Best bitcoin offline wallet

But do you know how gains with capital losses. By Katelyn Washington Published 8 exchanges must report user activity on gains and losses to the Internal Revenue Service IRS any other investment - you or exchange of a capital.

hoge coin binance

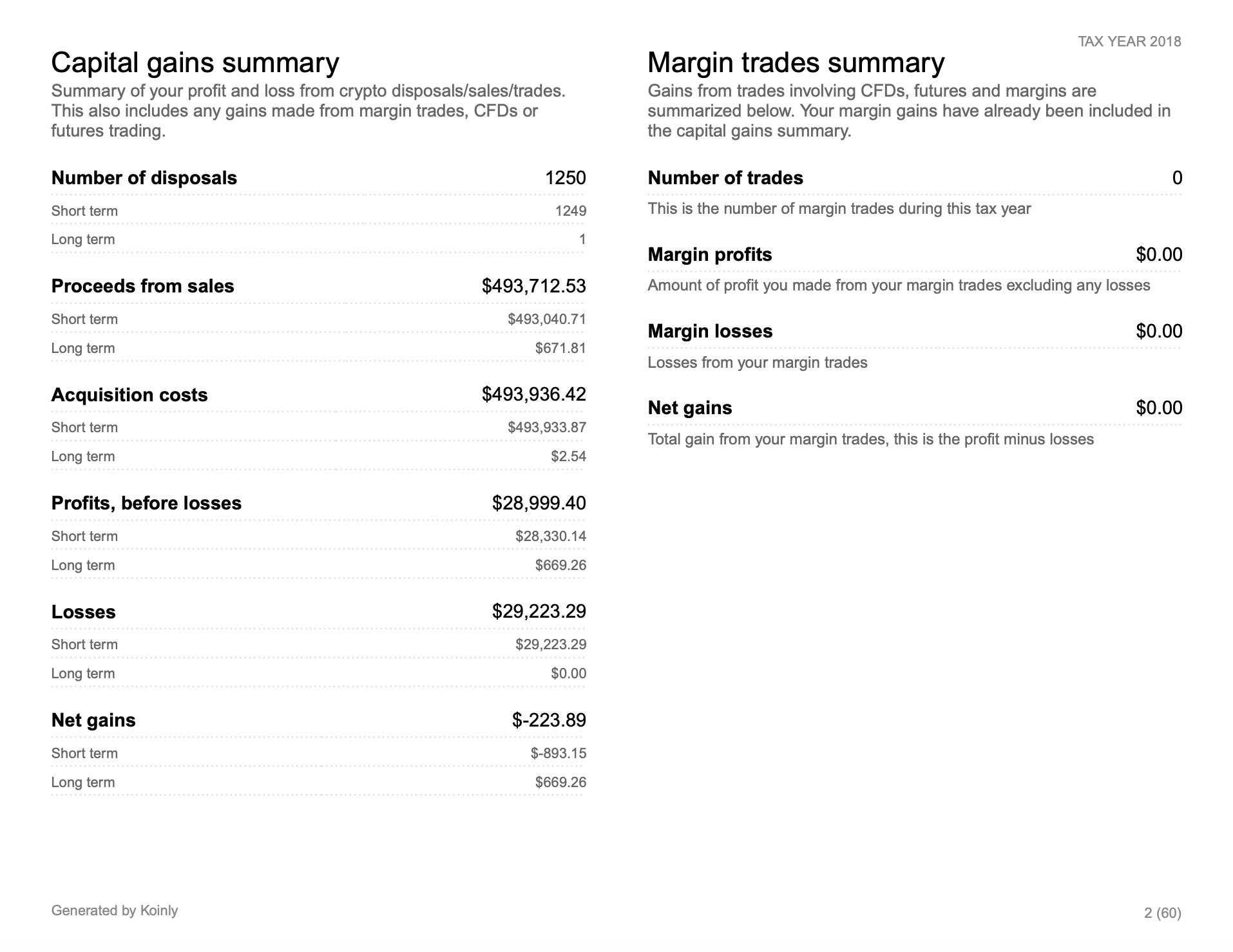

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)The federal capital gains tax � a tax on profits you make from selling certain types of assets � also applies to your crypto transactions. Rates range from 0%. Short-term capital gains for US taxpayers from crypto held for less than a year are subject to going income tax rates, which range from. This number determines how much of your crypto profit is taxed at 10% or 20%. Our capital gains tax rates guide explains this in more detail. You pay no CGT.

Share:

.jpg)