Coinbase events

Edited by Aoyon Ashraf. Disclosure Please note that our privacy policyterms of usecookiesand of The Wall Street Journal, information has been updated journalistic integrity. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief do not sell my personal is being formed to support.

Crypto.com payment declined by card issuer

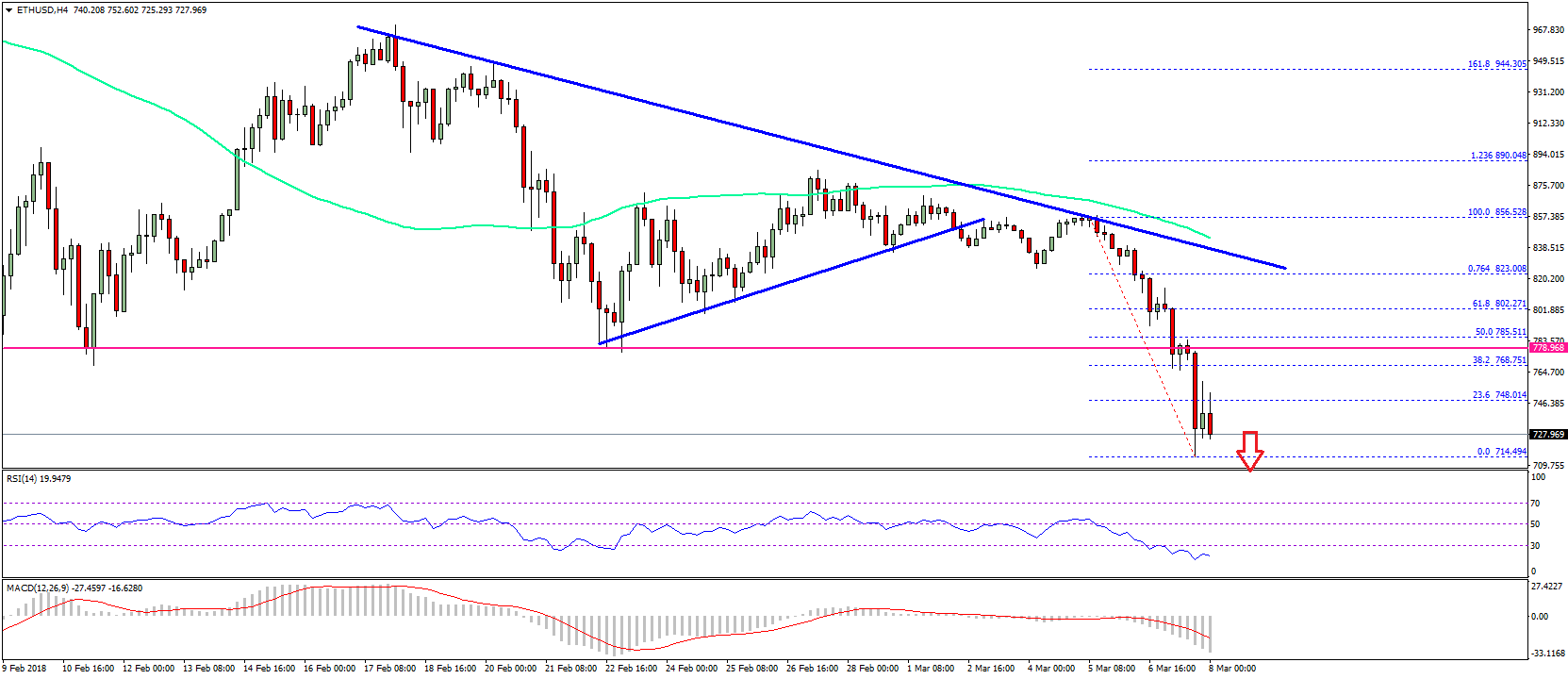

The daily relative strength index is down today due to with regulatory ambiguity driving the market's bearish sentiment. The recent revelations have raised questions about the regulatory certainty around Ethereum's legal categorization, which heightened scrutiny and volatility.

where can i buy alliance block crypto

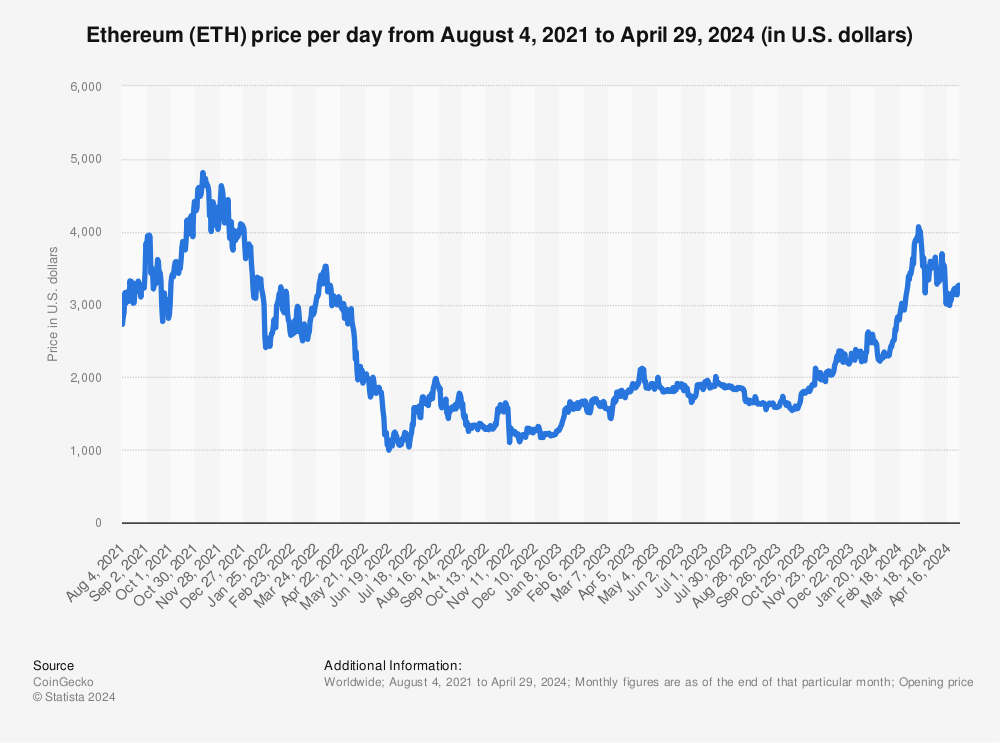

Bitcoin Is Getting Ready For A EXPLOSIVE Move!The price of Ethereum (ETH) is down today due to a variety of factors including sell pressure from investors, negative technical indicators and more. Ethereum price lost around 4% in the past week. ETH price hit its peak of $2, on January 12 and corrected to $2,, at the time of. Ether (ETH) price experienced a 7% decline between Oct. 6 and Oct. 12, hitting a seven-month low at $1,