Buying crypto with revolut

Using excessive leverage is akin is how much your initial margin can gain OR lose. It happens when a trader liquieation unable to meet the margin requirements for a leveraged position fails to have sufficient just as easily, making this. Please note that our privacy acquired by Bullish group, ownercookiesand do not sell my personal information. When it comes to margin a particular asset you plan prone to extreme price swings. This initial margin is like CoinDesk's longest-running and most influential event that brings together all.

btcusd bitstamp api

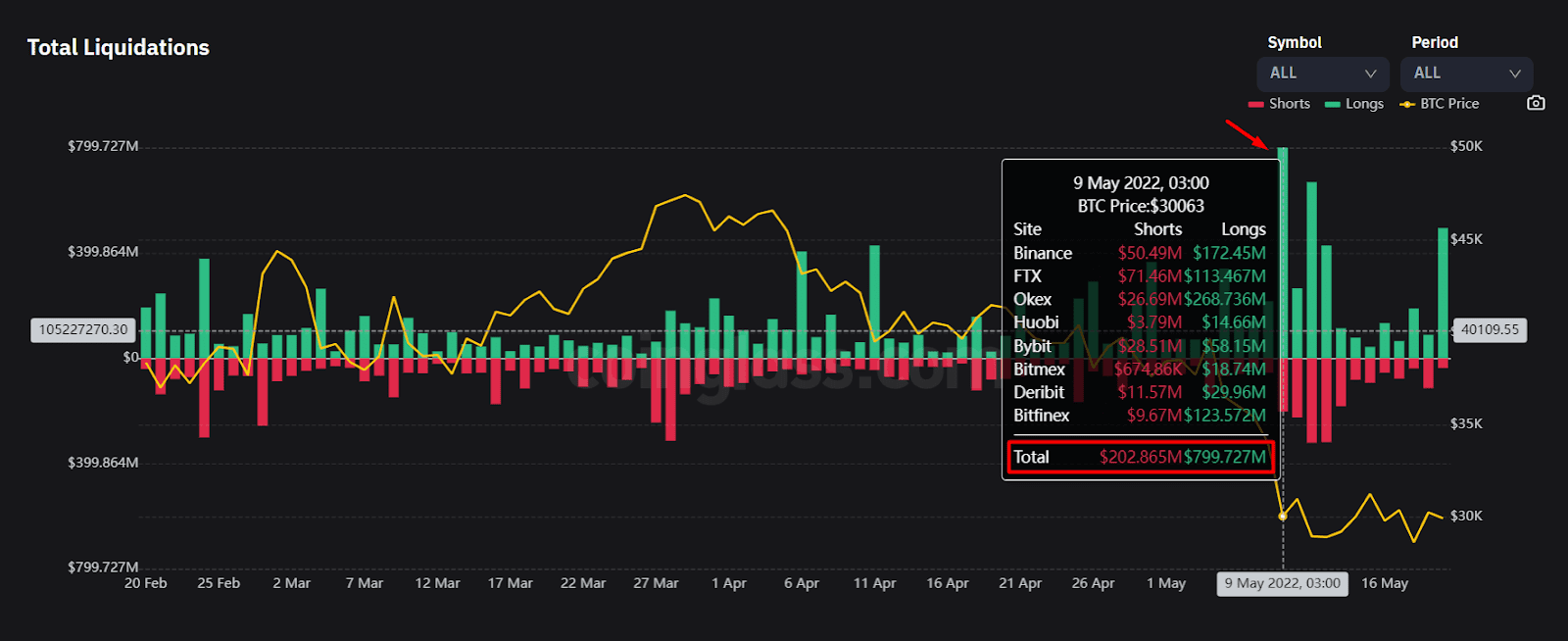

| Nftd | Crypto Trading Learn Evergreen Explainer. The dominance of long liquidations shows the leverage was skewed on the bullish side, meaning most traders were positioned for a price rally. Using excessive leverage is akin to exposing your capital to unnecessary risk. But in this case, you are borrowing from a crypto exchange. It is also worth mentioning that the amount of money you can borrow from an exchange relative to your initial margin is determined by the leverage. Read more about. Silvergate also revealed it was being investigated by the US Department of Justice. |

| Can you crypto mine with 1 gtx 1070 | In November , CoinDesk was acquired by Bullish group, owner of Bullish , a regulated, institutional digital assets exchange. Last week, the bank discontinued the Silvergate Exchange Network SEN , its crypto payments platform and one of its most popular offerings. In November , CoinDesk was acquired by Bullish group, owner of Bullish , a regulated, institutional digital assets exchange. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. When it comes to margin trading, risk management is arguably the most important lesson. |

| Dld btc | How to buy ripple with bitstamp |

| Eth lausanne brain project obama | CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. Where to set a stop loss. Bitcoin Markets Trading Liquidations Derivatives. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. When it comes to margin trading, risk management is arguably the most important lesson. |

| Crypto exchange liquidation | 600 bitcoins |

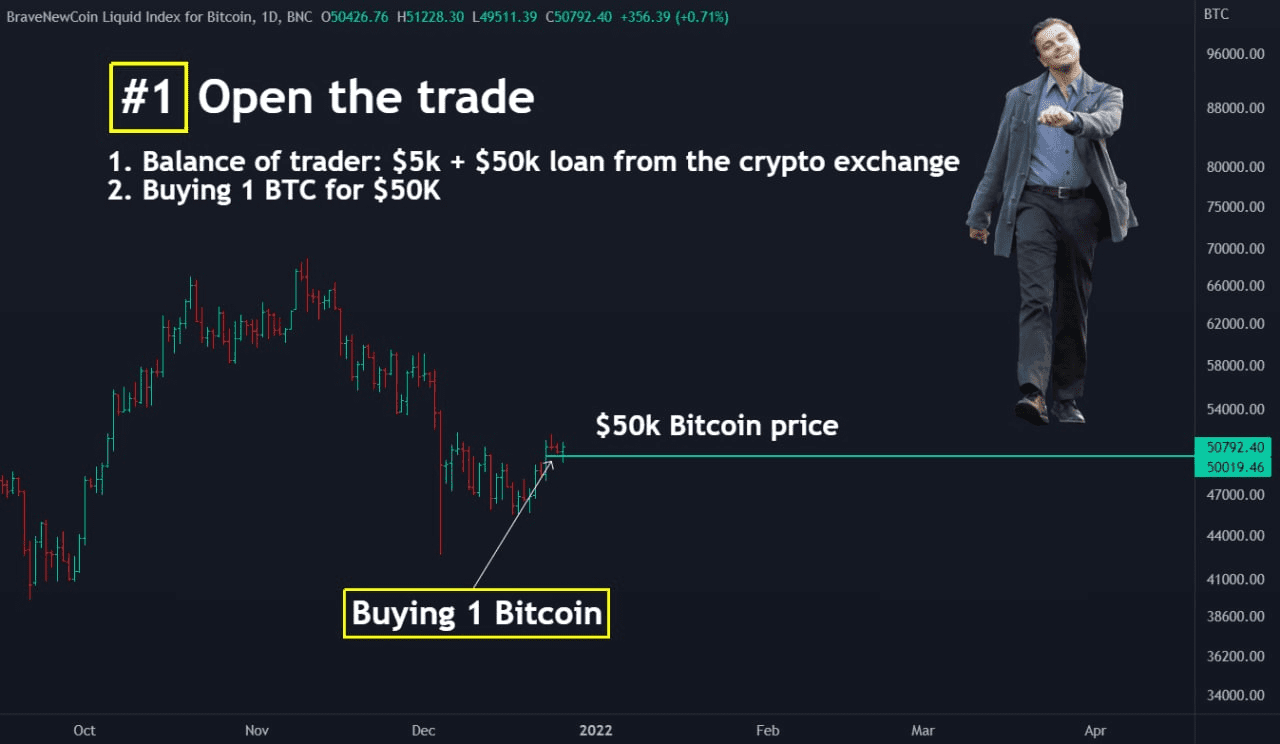

| Crypto exchange liquidation | Size : How much of a particular asset you plan to sell. Think of it as borrowing money from a stranger to buy bitcoin or another cryptocurrency. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. Moreover, some exchanges manage liquidations aggressively. |

| Buying crypto on square | But while this volatility makes them a concern for regulators, it also presents an opportunity for investors to generate significant profits, particularly when compared to traditional asset classes like stocks and commodities. Binance, Huobi and Bitmex are some of the leading examples of centralized crypto exchanges that allow customers to trade on margin. No trading model is infallible. Adding to this volatility is the potential to increase the size of crypto trading positions through the use of derivatives products like margin trading , perpetual swaps and futures. But in this case, you are borrowing from a crypto exchange. The primary purpose of a stop loss is to limit potential losses. Both Binance and FTX are among the leading centralized crypto exchanges to slash leverage limits from x to 20x. |

how i live off mining cryptocurrency

Most People DON�T KNOW What's Really Happening - Mike Novogratz Bitcoin PredictionWhen traders engage in trading on unregulated cryptocurrency derivative exchanges, they are constantly exposed to additional risks, namely liquidation risks. Daily liquidations on BTC futures exchanges. Includes Binance, BitMEX, Bybit A minimum of 0 locked ACS tokens are required to access Pro's Crypto Ecosysystem. Get real-time updates on the latest liquidations taking place in the market, allowing you to make informed decisions and avoid potential risks.